US tariffs cost American consumers 55% more

Goldman Sachs: With the potential implementation of further tariffs, the economic burden on families and businesses could increase further.

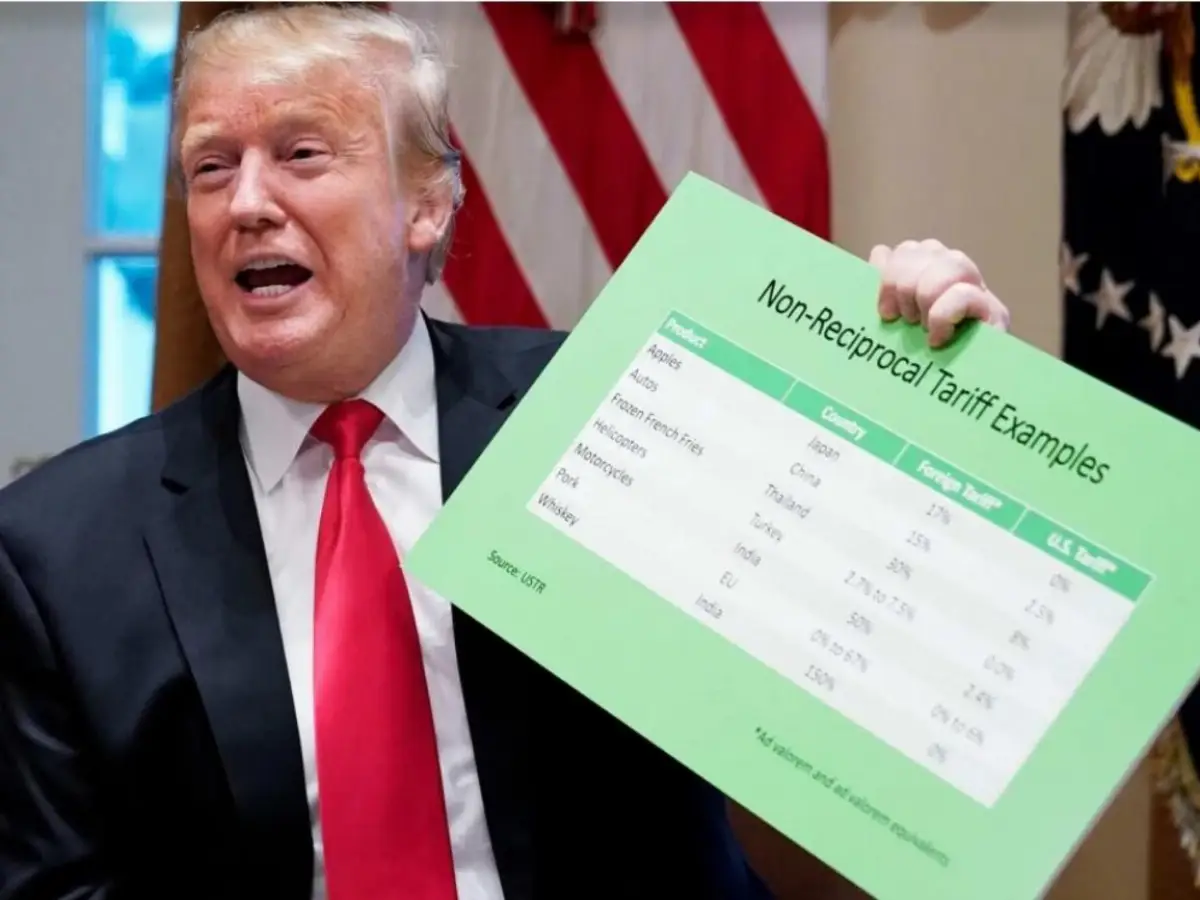

While the world is still holding its breath, awaiting daily developments in the ongoing trade war between China and the United States, Goldman Sachs has taken stock of the impact on the United States six months after the introduction of import tariffs imposed by President Donald Trump . According to initial projections, US consumers are already bearing up to 55% of the additional costs. And, of course, that's not all. The bank's analysts warn that, with the potential implementation of further tariffs, the economic burden on families and businesses could increase further, amplifying the effects on inflation and purchasing power.

The results of the recently released Goldman Sachs survey in the US suggest that American consumers will continue to struggle with high prices, which Trump had promised to address in his re-election bid. Although inflation rates have fallen from their post-COVID-19 peak, they remain above levels considered "healthy" by economists, causing consumers and businesses to continue reporting that they feel burdened by rising prices. Analysts estimate that the tariffs have added 0.44% to the Fed's preferred inflation measure. This figure could rise to as much as 0.6% if Trump follows through on his recent threats to impose tariffs on products such as furniture and kitchen cabinets. These tariffs were due to take effect today; in this scenario, analysts note, the burden of tariffs on consumers could increase by up to 70%.

Over the past six months, Trump has imposed tariffs on copper, steel, aluminum, and some automobiles and auto parts. He has also applied country-specific tariff rates of up to 28% on China and 16% on much of the rest of the world, according to the Yale Budget Lab. Partly as a result, consumer prices tracked by the Bureau of Labor Statistics (BLS) have increased every month since April, when Trump delivered his "Liberation Day" speech announcing the new tariffs (see EFA News ).

In August, analysts note, the BLS's benchmark consumer price index stood at 2.93%. The September data was delayed due to the government shutdown, now in its thirteenth day, and is scheduled for release later this month. Another inflation gauge favored by the Federal Reserve also continued to rise, reaching 2.7% in August, above the central bank's 2% target. Also in August, Trump disputed an initial estimate from Goldman Sachs that consumers could bear up to 67% of the cost of the tariffs.

From the beginning, Goldman Sachs notes, the Trump administration has emphasized the billions in revenue that the tariffs have brought in to continue justifying their existence, dreaming of a "trillion-dollar windfall" that will benefit the country (read EFA News).

According to Goldman Sachs analysts, American companies are waiting to see how the Supreme Court will rule on the tariffs, a matter the Court is scheduled to hear on November 5. Companies may also have stockpiled before the tariffs went into effect, allowing them to postpone a more significant increase in retail prices, Goldman Sachs analysts conclude.

EFA News - European Food Agency