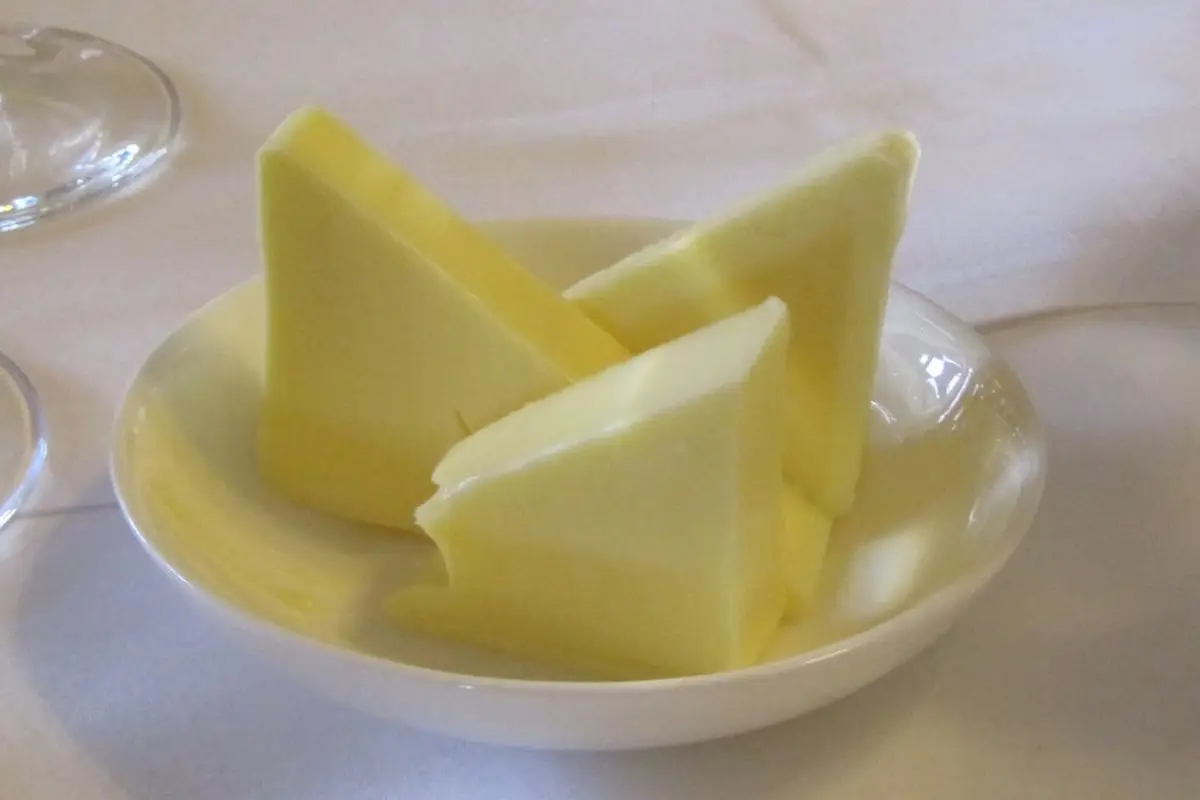

Commodities. Butter and cream: skyrocketing prices

Sugar and crude palm oil prices rise, but to a lesser extent. Lentils fall sharply

According to Aretè's weekly report, butter and cream prices are consolidating a record bullish trend. The EU reference for 82% butter, listed on the German Kempten market, reached a historic record of €8.5/kg; +55% since the beginning of the year and +87% compared to September 2023. The Milan Monza Brianza Lodi Chamber of Commerce lists Cream (40% fat) at €4.06/kg, +59% since the beginning of the year and +68% compared to September 2023. Areté analyses indicate market fundamentals as the main bullish factor, in particular the drop in supply, in a context of rigid demand.

Since the beginning of September, international sugar prices on the financial market The Ice have recorded significant increases: +20% and +12% respectively for raw sugar and white sugar. The fires that have characterized the state of São Paulo, the main production area in Brazil, have in fact fueled expectations of a lower output in the second part of the Brazilian campaign. These concerns are added to a persistent drought in the country. The potential weather impact on Brazilian production, initially quantified by Areté at around -2.7 million t, could be greater as the estimates on the hectares affected by the fires have been revised upwards from 80k ha to 400k ha and the drought has further worsened. In the European Union, prices instead confirm the downward trend of recent months: on average, between August and September, the Spot Europe and Delivered Central-Northern Italy prices recorded by Areté fell by 6% to around €560/t.

After the marked deflation that, between the end of June and the beginning of August, characterized the Richlea USA lentils (-42%), prices recorded a reversal of trend marking a +14%; +10% in the last month alone. According to Aretè analyses, the reversal is partly attributable to the return of demand stimulated by price levels that have already discounted the expectations of North American harvests higher than the previous campaign (+44% Canada and +67% USA).

The price of crude palm oil listed in Rotterdam has increased by 15% since the beginning of July, maintaining an average premium over refined palm oil. According to Areté analysis, this upward trend has been supported by the strong weakening of the dollar against the Malaysian ringgit, whose USD/MYR exchange rate has decreased by 10% for the same reference period. Not even the news that the world's largest importer of palm oil, India, has increased its import duty from 5.5% to 27.5% has slowed the growth of international prices. Concerns about Malaysian production, supported by high rainfall caused by the development of La Niña in recent weeks, and a robust international demand are keeping international prices under pressure, with crude palm oil listed in Rotterdam reaching a 2-year high.

EFA News - European Food Agency